Business electricity buyer's guide. Part 2: Two insider tips and three buying strategies to help you deal with rising energy prices

There’s one thing every customer has in common – the desire to get the best price for their next business electricity contract.

There are two decisions you need to make to achieve that:

| When to secure your price. Do you: | How long to secure it for. Do you: |

or

|

or

|

If you’re confused which are the right calls this year, you’re not alone. Many of the costs that make up your price have been rising recently. So chances are any new price you’re quoted today will look significantly higher than your current price (which reflects the costs of a year or two ago). (Get a more detailed explanation in Part 1 of this buyers guide).

Don’t guess nor hesitate (rarely good strategies). Read on for our two insider tips and three buying strategies to help you make the right call and get the best deal for your next contract.

INSIDER TIP 1: Don’t get caught up in the October rush

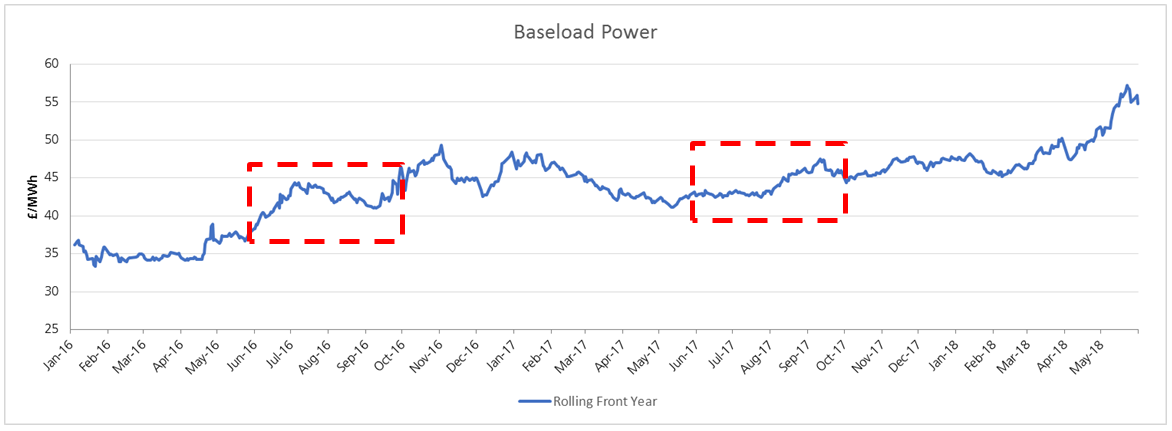

The graph below shows the wholesale power price from the start of 2016 to date and we’ve highlighted the lead up to the all-important October contract round. We can never predict the future of the power market, but you can look to make decisions using the information available to you. Market fundamentals such as oil and gas are the main driver of the wholesale power price.

However with so much uncertainty and risk it may be best to lock in your contract at an earlier date.

This peak in buying activity has another effect. The lead-up to October gets busy. Our account managers work flat out during September once everyone is back from holiday and keen to secure their contract in time for 1 October. Starting your buying process during the quieter summer months can put you in a much better buying position.

INSIDER TIP 2: Watch the market fundamentals to understand what causes wholesale power costs to change

Recent market volatility has reminded us that you can’t take your eye off the energy cost, the cost of power on the wholesale market. This is still the single biggest component of your electricity price making up the 40%.

The price of oil and gas as well as the geo-political climate all impact the wholesale power price. Read what’s caused the recent price volatility and what to watch for to make an informed decision.

That’s a lot to keep tabs on. To make that easier for you, we publish all our latest analysis and figures in our Market Insight portal. Take a look.

So what are your buying options?

There’s no nice way to say this, so I’ll just say it straight. As things stand, you’re likely to see a significant difference between your current rates and your next contract’s prices.

Here’s a way to think about the options in front of you:

| Option | Why | Upsides | Downsides |

1. Sign a 1 year contract now | You think prices are likely to rise further | - You’ll avoid future rises you’re worried about | - You’ll kick yourself if prices fall before your current contract ends |

2. Wait to sign your next 1 year contract | You think this is a blip and prices will fall before you have to sign your next contract | - You’ll avoid locking in what you see as a blip in prices | - You’ll kick yourself if prices continue to rise |

3. Take a longer-term contract now | Because power prices for 2020 and 2021 are currently lower than the 2019 prices you see in the chart above, offsetting the rise in non-energy costs | - You can set your budget for longer. Rates for 2 or 3 year deals are close to the price you’ll pay for 1 year | - You’ll still kick yourself if 2019 prices fall before your current contract ends, but not as hard as if you signed a 1 year contract now. |

If your business uses more than 2GWh of electricity annually (roughly £200k), you can access more sophisticated contracts that can help you manage your exposure to these costs by staggering your energy purchases. Speak to your account manager today to find out more about our flexible contracts.

We’re here to help

Higher prices are never good news. And it’s impossible to predict precisely which way they’ll go next (I wouldn’t be sitting here writing this if I could). But at least now you’ve laid out your options and know where to go to track all the costs behind your electricity price (hint: it’s Market Insight). So you can make a decision with more confidence.

When you’re ready for a quote for your next business electricity contract, call your EDF Energy account manager directly, or via 0800 328 9030. Try us today. You have nothing to lose.

One last thing.

If there’s a plus side to higher electricity prices, it’s how they make finding new energy efficiency opportunities even more important for your business. Fortunately we have a new service that can help you. It’s called Power Report and works like this:

We run your energy data through our new machine-learning application

You get data-backed recommendations of where you’ll find the best energy saving opportunities in your buildings.

Quick, cost-effective, reliable. To get your Power Report, speak to your account manager.